Sector Update / Metals / Click here for full PDF version

Author(s): Ryan Winipta ;ReggieParengkuan

- Rupiah weakness (-6% YTD vs. US$) have boosted preferences for commodity-equities under our coverage.

- But, aside from weak Rp and ongoing geopolitical tension, underlying commodity fundamental are robust, owing to favourable S-D balance.

- Metals should benefit amid geopolitical tensions despite elevated DXY; upgrade our sector rating to Overweight (from Neutral).

Rupiah weakness is positive for commodity equities

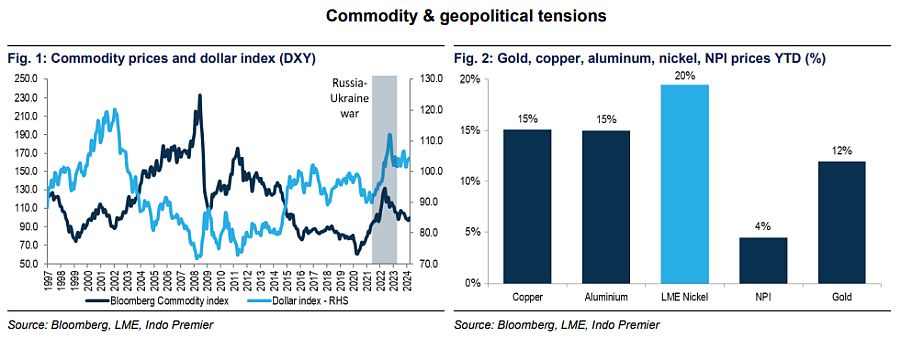

Indonesian Rupiah has depreciated by -6% YTD to Rp16.2k level against US$, owing to recent bond outflow of around US$2.2bn in mid Apr-24. This has shifted local funds' preference from typical big-cap banks, , and consumer names into commodity-equities - i.e. , , , , , etc, boosted by light local fund position. We think such sector rotation would continue especially if Rp weakness concern persists. At the same time, underlying commodity prices (energy and metals) such as oil (+13% YTD), gold (+12% YTD), copper (+15% YTD), and nickel (+20% YTD) are on the uptrend and has positive medium-term outlook.

Commodity prices often surged amid heightened war tensions

Historically, commodity prices, incl. energy, metals, and soft-commodity (i.e. cooking-oil, food) were moving in tandem amid intensifying geopolitical tensions & wars such as the 2022's Russia-Ukraine conflicts, and recent Iran-Israel attacks (Fig. 1). Notable wars such as WW1 and WW2 for example, often triggered higher demand for energy and industrial metals (for artillery), whilst disrupting supply-chain, leading to tighter supply, and higher prices.

Without the ongoing tensions, commodities are fundamentally sound

But, even without further geopolitical tensions, commodities under our coverage should benefit from S-D balance standpoint, with: gold prices benefitting from central bank buying (i.e. China) amid the concern in U.S fiscal & debt situation (report), copper prices benefitting from joint production-cuts among Chinese smelters, causing tight supply in the concentrate market - reflected in the low TC/RCs, and nickel, from potential demand tailwind due to higher military spending (up to ~10% addl. demand)

Upgrade to O/W with preference on metals over energy

We upgraded our sector rating to Overweight (from Neutral) as we think prolonged conflicts between Iran-Israel coupled with persistent weakness in Rupiah would boosted preferences to US$ earners such as metal miners under our coverage. We prefer metals over energy as we think crude-oil may not surpassed US$95/bbl mark vs current level of US$89/bbl, as higher production is likely to come after oil price surpassed beyond US$95/bbl level, which may limit upside for natural gas and coal.

Gold > Copper > Nickel; & as our top pick

Our metals pecking order (in the order of preference): Gold > Copper > Nickel, with gold as our most preferred commodities owing to central bank buying as geopolitical tensions' safe-haven and in nickel, we prefer LME over NPI/sulfate (report) with (Buy) and (Buy) as our top picks. Downside risks are lower than expected economic growth.

Sumber : IPS